As hospitality rebounds from an unprecedented shutdown, hoteliers are in some ways starting from scratch, and the temptation is there to fill rooms with any available demand. In this report, we examine why recovery hinges on operators remembering past lessons and remaining steadfast on optimizing distribution and channel mix.

The Dynamic Hotel Distribution Landscape

It might have taken a little longer than many hoped, but hoteliers over the past decade have made incredible strides toward a more profitable distribution mix.

The heated battle between OTAs and hoteliers over undercutting rates and overcharging commissions had simmered the past few years as many top brands introduced successful direct booking campaigns and OTAs lost much of their dominance. Google’s pronounced landing in the hotel metasearch space punctuated hoteliers’ ability to effectively drive more business to their most cost-effective channels.

The days of fearing that Expedia and Booking.com would dominate distribution and bankrupt hoteliers’ business were seemingly over. After gobbling up most of the other third-party distribution sites and building what appeared to be a duopoly, Expedia Group and Booking Holdings found themselves facing shrinking margins and new competition from Google and Airbnb.

In addition, hoteliers in recent years have gained more granular insights into the cost of each of their distribution channels and the relevant information to make educated decisions on how to acquire guests more cost effectively. But, COVID-19 and the subsequent travel shutdown has flipped hotel revenue and marketing decisions upside down. Understandably, in many cases, traditional channel-mix best practices have been tossed out the window.

Today, hoteliers grappling with the business impact of the COVID-19 pandemic are faced with a difficult distribution challenge: On one hand, there is a short-term need for the revenue obtained by putting heads in beds; this is the lifeblood that keeps staffers employed and the lights on. But on the other hand, there are also long-term profitability and market value considerations, which often necessitate a more stringent distribution approach.

While it’s often easier said than done, the data has shown hoteliers the recipe for success: Be open and available on every channel that provides incremental demand, while preventing undercutting and leaked inventory.

However, with unprecedented times come unprecedented challenges. Hoteliers – in many cases reopening their doors after month-long shutdowns – can’t afford to be greedy with incoming demand. Rooms need filled and, in many cases, there is little manpower for measuring acquisition costs. Right now, it’s about developing a baseline of business.

It’s a tough balance, but a critical one for hotels to remain open and operational well into the future.

Time for a reset

Hotels across the world are experiencing changes never seen before in consumer behavior. Occupancy can jump from 40% to 95% overnight, which unfortunately means the historical data hoteliers have always used to build their strategies no longer applies.

As demand begins picking up, hoteliers will undoubtedly capture as much as they can with any marketing and promotions they can muster. But it’s important hoteliers are cognizant of the types of demand that are picking up first and what channels guests are booking through.

Understanding more about your guests, including source markets and acquisition channels, will help hoteliers understand how they can build a quick base of business before strategizing to fill in the gaps. But it will also set you up to make more profitable business-mix decisions in the long run.

“You want to be open on all shelves for the moment, because unfortunately we don’t have data to make decisions until after we start receiving bookings,” says Lily Mockerman, founding partner of ThinkUp Enterprises and CEO of Total Customized Revenue Management. “Until we can measure unconstrained demand, it’s hard to put in a good strategy. Hoteliers should be excited about direct bookings, but I wouldn’t say pull back from Expedia or Booking.com.”

Marketers, informed by demand data from the revenue team, should take this opportunity to reset.

“If you go back to your blissful world and turn everything back on, you’re going to waste money and you’re not going to get what you need,” says Edward St. Onge, president of Flip.to, a brand advocate platform for hotels that turns guest feedback into marketing. “This is not a situation where inherent demand exists on a high level, where you can rely on old strategies. You need to be aggressive, guerilla-style marketing, making travelers choose you as a destination.”

Coming out of lockdown, travelers are searching for trips in new ways. One channel to pay close attention to as demand rebounds is metasearch, according to experts, and that includes Google.

“Independent hotels can play well in metasearch, but they’ve always struggled with barriers to entry. It’s a nice-to-have channel that can convert well, but was the first to be dropped after COVID-19 reduced marketing budgets,” says Tristan Heaword, cofounder of three&six, a hospitality digital marketing agency. “But Google is now really promoting their commission model, and it’s going to be interesting to see how hotels use it to approach direct marketing.”

In short, hotel distribution strategy post-COVID-19 will require flexibility. Pivot, and pivot again. Your strategy shouldn’t be the same in three months, and will likely change every couple months for the foreseeable future.

IN BRIEF

OTAS REMAIN INNOVATIVE

As 2019 came to a close, it was clear the hotel booking arms of the duopoly – Expedia Group and Booking Holdings – were under pressure. Commissions and revenues were slipping, and much of the blame was pointed at a newcomer in the space.

Since November, Expedia executives have been attributing part of the company’s poor performance on Google diverting traffic to its own travel products, forcing Expedia to use Google’s higher-cost channels. After Q1 2020, the company reported a 15% revenue loss to $2.21 billion, with lodging revenue decreasing 10% in its first quarter on a 14% decrease in room nights stayed.

However, in the midst of the coronavirus crisis, the company secured more than $3 billion in private equity financing to enhance its liquidity. Expedia executives said they will reset the marketing approach by centralizing efforts across all subsidiaries so brands won’t be competing on Google against one another, driving up the cost-per click for each.

Recently, Expedia announced it would dedicate $250 million to lodging suppliers in the form of marketing credits and financial relief. Cyril Ranque, president of Expedia’s Travel Partners Group, said the relief program was borne out of conversations Expedia had with suppliers about what the OTA can do to assist

them in recovery.

“Candidly, there’s been a lot of [responses] from lower commission, to give me free marketing money, to give me cash, to leave me alone, to give me demand data, etc., etc.,” Ranque told Phocuswire. “We tried to build a program that addresses a little bit of all of these types of asks.”

In a statement, Expedia representatives said the program helps lodging suppliers maximize cashflow through reduced compensation and extended payment terms for the duration of the program. It will also offer marketing credits to boost visibility in the search results, attracting the attention of customers, the company said, adding: “Expedia is increasing customer confidence in travel by displaying health and safety measures in property listings and updating its sites to allow for flight searches by flexible fares.”

On Booking Holdings first-quarter earnings call, CEO Glenn Fogel said the company began to feel the real impact of coronavirus in mid-March, and the month ended with more cancellations than bookings. The company notched a net loss of $699 million in the first quarter compared with profits of $765 million a year earlier. Revenue decreased 19% to $2.3 billion.

Google’s push into the traveler’s booking path was slow and calculated. In late 2018 and throughout 2019, though, it became clear that Google was looking to capitalize on its place atop the travel funnel. Today, the company is focused on improving the travel journey by connecting with travelers in the right context and with the right content. Instead of feeling threatened by the search giant, many feel the opportunity is there for hoteliers to work with Google to drive traffic direct. It will, however, come at a cost. The company launched Book on Google, connecting hotels and travelers by bypassing OTAs, for a cost per booking. It merged Google Hotel Ads and Google Ads products, effectively creating a hotel metasearch, and introduced a hotel pricing tracker.

Google has steadily been improving the interfaces toward a more modern search experience on both desktop and mobile. Recently, Google updated its ads product, opening a commission program where hoteliers only pay a commission if a guest stays at the hotel, automatically adjusting Hotel Ads bids to maximize booking value.

The company also rolled out a “Free Cancellation” filter for travelers searching for hotels where rates are refundable.

Improve your distribution channel mix with ease and reliability, with Windsurfer CRS

HOTEL TALK

4 TIPS FOR CAPTURING BUSINESS IN A NEW NORMAL

1. Make sure your guests and associates feel safe at your hotels.

2. Be smart about how you’re spending the limited marketing

dollars you have.

3. Understand where demand is coming from, and make sure

you have the right offers available.

4. Look at data every day to understand what’s working,

and be nimble enough to adjust strategies quickly.

- Linda Gulrajani, VP of Revenue Strategy and Distribution, Marcus Hotels & Resort

Managing OTAs Will be Key to Early Recovery

As guests start to trickle in the doors again, one thing is becoming clear: OTAs are in a prime spot to capture early returning demand.

OTAs are popular with driving travelers and those looking for value, both key sources of demand for roadside hotels that are experiencing the first upticks in business. Metasearch is a popular option for value-seekers as well, and OTAs tend to outspend their supplier counterparts in this channel. Simultaneously, alternative accommodations and short-term bookings are on the rise as travelers try their best to maintain social distancing guidelines.

OTAs will undoubtedly provide a key source of near-term bookings and hoteliers will find themselves in similar situations as they were post-9/11 and post-2008 financial crash: relying on distribution partners to fill hotel rooms. Armed with the right information this time around, though, hoteliers are capable of learning from past mistakes and developing better working relationships with their distribution partners.

“There are going to be segments taking bigger hits than others, and OTAs are seeing the same. They have marketing power, but it’s still the same story that demand is down,” says Johnathan Capps, VP of Revenue at Charlestowne Hotels. “Looking around the industry, we will all admit that during the last downturn we gave too much to OTAs, and now there’s an opportunity to learn from history and say we’re not going to repeat that again. It doesn’t make sense to offer up a sale to Expedia at 35% off and bring the rate $100 below market. Demand will still be dictated by the consumer’s want to travel.”

At the 61-room Long Beach Lodge Resort in Tofino, British Columbia, Director of Revenue Management Heather Riddick has been ramping her property to reopen after more than two months. Riddick says that, because Long Beach Lodge is a destination resort, she has the luxury of waiting until midsummer before turning to OTA channels, currently only taking about 10% of her business through distribution partners.

EVOLVING DISTRIBUTION DECISIONS BUILDING SMART OTA PARTNERSHIPS

Recently, we’ve seen some hospitality revenue leaders suggest that improved distribution agreements are just one component of a more comprehensive commercial strategy, and that revenue and marketing should report to a commercial or revenue officer, who is informed by data and can set collaborative strategies among the departments.

In this environment, distribution specialists could be more focused on the role of drip marketing strategies and omnichannel marketing efforts that will drive direct business, says Mike Medsker, president and cofounder of Focal Revenue Solutions.

“We can expect to see the traditional boundaries between sales, marketing and revenue optimization blur as hoteliers realize that generating new demand will require a more holistic approach to their business,” he says.

A key role for whoever oversees distribution is measuring return on promotions, and a more holistic view of distribution requires moving away from a last-click attribution model that fails to track the complexity of the customer booking journey, Medsker says.

Medsker put it succinctly: “Hotels should offer the same rates and availability to the OTAs that they are selling directly, period. With very few compression dates anticipated in 2020, staying in good standing with your OTA partners far outweighs the small incremental benefit of holding back availability or breaking rate parity clauses.”

He also suggests hoteliers be extremely wary of opaque channels and packaged inventory, saying some OTAs have taken steps to reduce the opacity of these rates, leaving customers the ability to know which hotel they will receive before booking.

“This erodes retail pricing credibility and leads to rate leakage, as customers who might have booked your hotel directly find they can do so more cheaply on Priceline or Expedia,” Medsker says. “The best way to fight back against the OTAs is to decline to participate on these paths.”

At Choice Hotels, VP of Revenue Management Douglas Lisi agrees that an important way for hotels to build and reinforce guest relationships is by maintaining rate parity and price integrity. Hotels should have consistent room rates no matter what method the guest is using to book – phone, website, etc. – or what website is being used, he says.

“Maintaining rate parity is a consistent challenge across the industry, and one that Choice Hotels’ revenue managers and general managers work every day to align,” Lisi says.

HOTEL TALK

BE CONFIDENT IN YOUR OTA STRATEGY

“Rate leakage is a huge concern. The OTAs know who they are working with; they are salespeople and know what’s on the other side. They might be going to hotels without a full revenue management strategy and say they’re seeing demand in the market and that’s an opportunity. The GM might jump on that thinking they need the business. On the other side, how long is that going to run? What’s it going to do to the three other competitors in the market? So, you need to be smart on how much you give up.”

- Johnathan Capps, VP of Revenue, Charlestowne Hotels

“Hotels need to continuously monitor different channels to make sure that they are in parity across all channels and invest the time in manually shopping various sites. There are great tools to help you see if you are getting more than your fair share of business from the OTA channel. ROI will never be exact on an OTA offer, but using a combination of OTA data and competitor data can help you estimate results.”

- Linda Gulrajani, VP of Revenue Strategy and Distribution, Marcus Hotels & Resorts

“OTAs serve a very important role in attracting guests who may not otherwise have chosen to book directly, but that business can’t come at the expense of deep discounting or breaking parity agreements, which causes more harm than good. If a potential guest finds varying rates for the same hotel room across different distribution channels, they lose trust in that hotel and are less likely to stay loyal

in the long term.”

- Abhijit Patel, VP of Marketing and Distribution Strategy and Operations, Choice Hotels

ASK THE EXPERT

PROTECT YOUR DISTRIBUTION INTEGRITY

5 Questions with Dori Stein CEO, Fornova

Q. Do you see hotels remaining focused on optimal channel mix post-COVID-19?

STEIN Cooler distribution heads will prevail during the crisis, led by the efforts of the larger chains, which will reveal a divide between hotels that focus on channel mix, and those that do not. The major hotel brands will all likely devote staff to maintain distribution integrity, so there’s less leakage, less undercutting and the best prices on the Brand.com sites. Direct bookings, in general, are also on the rise, further fueling this trend.

Because most hotels will require financing to survive and are facing difficult conversations with banks, we may see some owners enticed to join one of the big brands, as this may be their only option for lending when occupancy is down. But even for those hotels that choose to remain independent, there are still reasons to continue to safeguard distribution.

Hoteliers can work to preserve distribution integrity and show lenders higher profits, not just revenues.

Q. When would it make sense to market more through OTAs?

STEIN Hoteliers can make use of OTA tools that allow you to market to specific markets or specific verticals that are relevant to your hotel. Then you can monitor your competitive landscape in each of the OTAs, because they will all be different. Invest in more niche marketing, especially in terms of geography. Be sure to understand your source markets and confirm you’re running the smartest promotions targeting them.

Q. How will the pandemic have an impact on the distribution technology landscape?

STEIN Hoteliers are going to be looking for more automation and more lightweight tools to help that are also more budget efficient. In the short term, it’s going to be a challenging road for big-ticket tools such as full-feature revenue management systems.

The ability to provide hotels with these resources will be another feather in the caps of the major brands during the crisis.

Q. How can hotels tap available data to make smarter distribution decisions?

STEIN Before analyzing your pace and internal data, which are also important, hoteliers must first understand who the competition is, which probably has dramatically changed post-COVID. For example, today, more than ever, your competition is vacation rentals. They’re going to recover before hotels.

But a critical use of data in the current marketplace is to make sure your hotel has the most competitive pricing compared to its market. There’s less demand, and the demand that does exist is dramatically more price conscious because these guests have less disposable income in the current environment.

Will Direct Bookings Momentum Continue?

Most experts agree that hotel loyalty programs are in a different position than they were in past recessions, so we likely won’t have a replay of the earlier recoveries to count on, at least in the U.S. One thing is clear: In past recessions, hoteliers gave up a lot of their power to the online travel agencies. Will they learn from the past this time around, or will the work the industry has done over the past decade in coaxing the guest to book direct be lost?

“Prior to the current crisis, hoteliers were beginning to challenge their assumptions around optimal business mix. For example, despite a general consensus that third-party business is more expensive than business from guests that book direct, very few hoteliers have been able to do much about it,” says Mike Medsker. “Reducing your participation on low-value channels requires that you first increase conversion or drive demand through your high-value channels; otherwise, you are simply limiting your total revenue potential.”

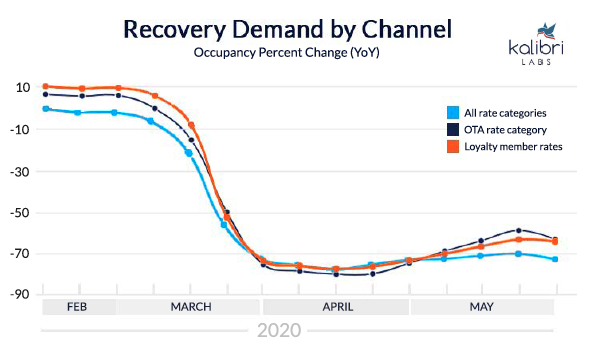

Early recovery data from Kalibri Labs shows Average Daily Rate and occupancy are growing in primarily two rate categories: OTA and Loyalty Member Rates, a big change from previous downturns where OTA dominated the recovery in the early stages.

“If this pattern persists, then hotels would be smart to leverage their loyalty and book direct programs for the higher profit contribution,” said Cindy Estis Green,

CEO of Kalibri Labs. “Costs from third-party business generally run at least twice that of direct.”

With that said, OTAs aren’t going anywhere. As long as people want to travel, these third parties will fight for their share of demand. That’s why hoteliers need to learn how to control their relationship with intermediaries.

“We’ve always been open with them,” says Heather Riddick, director of revenue management at the Long Beach Lodge Resort in Tofino, British Columbia. For her, it’s about managing the channels based on a property’s guest makeup and needs. For European travelers, she turns to Booking.com, while Expedia is used heavily by the Canadian market.

“We’re using them more often to push to our shoulders and get that extra reach. The benefit of Expedia and Booking.com is their marketing,” she adds

BRANDS WON’TGIVE UP THE FIGHT

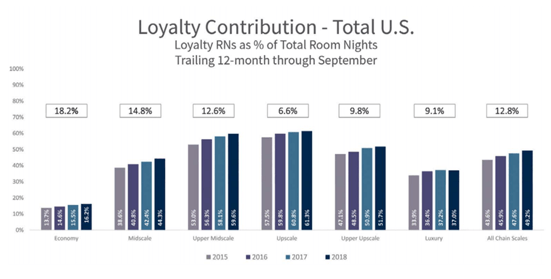

But, don’t count out the brands. Their future depends on the momentum they’ve gained in the direct-booking cause, and they will fight back hard. A 2018 report (“Book Direct Campaigns 2.0: A Special Report”) by Kalibri Labs says “Book Direct” campaigns launched by many of the big brands the previous year have in fact been successful in “either stabilizing or strengthening the growth rate of bookings via proprietary hotel company websites.”

Drive more direct bookings with a high converting booking engine like Windsurfer

Kalibri has been examining hoteliers’ efforts to drive direct business through their loyalty programs, which often present a 10% discount or similar offer to entice travelers to join their loyalty programs and book directly with the brand or the hotel. “Bookings growth for online travel agencies during this period either held steady or decelerated, signaling a shift for the hotel industry,” Kalibri says in the report.

Almost three years after the launch of the first industry Book Direct loyalty member programs, a study sample of 19,000 hotels and 80 million transactions provides conclusive evidence with some variation between hotels but a common pattern. The loyalty member campaigns had either strengthened or stabilized the growth rate of bookings through Brand.com, while the OTA channel had either held steady or has somewhat decelerated, according to Kalibri.

A MARKETING-FIRST APPROACH

Smart marketing will continue to be key to maintaining and gaining share in the space. “You almost have to take a marketing approach first. What does that look like coming out of the pandemic? Is it cleanliness, amenities or a physical plan? asks Johnathan Capps, VP of revenue at Charlestowne Hotels. “You almost have to redo your comp set analysis to understand your positioning. Is there something you can highlight, change, or can you do something small to position yourself better?”

Capps points to exterior properties within the company’s portfolio as a prime example. While he says these hotels aren’t as attractive in the winter, for instance, they are an appealing option for guests within the context of an aftermath of a global health pandemic. “We’re taking that piece and highlighting it,” he adds. “You can park in front of your room and walk right in.”

Hoteliers also need to fully understand what types of guests are going to have demand for their hotel — and they can’t rely on past strategies in such unprecedented times. That means the hotel’s business mix is likely to change — sometimes week by week, or day by day.

“It’s unlikely you’re going to have international travelers. But there’s a yin and yang that means people in feeder markets are also not traveling internationally and are up for grabs,” says Edward St. Onge of Flip.to. “You need to adopt a ninja mentality and educate them as to why they should come to you.”

That means if hotel marketers find that pocket of people, it’s time to pour the budget in, and then move onto the next pocket, he says. “How do you make them aware of you? It’s not just about how to be present. If you wait until they are looking for options, you’re going to be in much harder competition. You need to pull them in, and you will destroy your comp set.”

However, marketers need to be aware that drive and feeder markets today might not be what they were previously. Just because hoteliers thought they knew what those were yesterday, doesn’t mean they are still correct today.

“There’s a new market, and it’s bigger than the old market.”

“You need to realize that you don’t know anything right now. A lot fewer people travel to the U.S. than out of it, about 19 million trips. You have 19 million additional people you wouldn’t have otherwise. There’s a new market, and it’s bigger than the old market,” says Stuart Butler, COO of Fuel Travel. “You have to go out and hunt for it; you have to be more ruthless.”

Specificity is key, too. “Budget dollars are being trimmed, so it’s important to be ultra specific with spending dollars. As we work with marketing teams, geo-targeting has been a buzzword,” Capps says. “We might have been casting a wider net with business coming in from a 200-mile range. Now, it’s more important to define that down inside maybe 100 miles within a market or submarket. If we’re targeting a region of Charlotte, do we drill down into Southern or Eastern Charlotte?”

“Hoteliers are currently spending hours each day manually compiling reports, only to realize that they are obsolete the following day.”

- Mike Medsker, President, Focal Revenue Solutions

TRACKING DEMAND, ROI BY CHANNEL

The COVID-19 crisis hit the industry with such speed and force that hoteliers have struggled to track and respond to trends as the situation has evolved. But, in order to rebound successfully, hoteliers need to be nimble in their approach and adapt. Tracking demand and return on investment by channel will be more important than ever in the coming months as the industry looks to regain its once burgeoning profitability.

“Hoteliers are currently spending hours each day manually compiling reports, only to realize that they are obsolete the following day,” Medsker says. “Now more than ever, it is critically important that hotels equip themselves with the tools and processes that will allow them to view and track bookings in real time.”

While the usual suspects such as market segmentation and channel mix remain important, he says hoteliers need to think about them differently and combine data in new ways. Hotels should be able to explore the relationship between market segments and channels. For example: Am I more successful at driving retail business through my website or voice channels? What’s the mix between customers booking retail and discounted rate plans via the OTAs? Additionally, hoteliers are paying attention to metrics around geo-targeting and new vs. net vs. cancelled bookings.

“The ability to successfully leverage historical data in the age of COVID-19 has waned because there are so many changes day to day. Now, it’s more insightful to take a forward-looking approach in observing industry forecasts as well as customer and competitor trends that will ultimately shape recovery strategies,” says Douglas Lisi, VP of Revenue Management for Choice Hotels International.

HOTEL TALK

DEFINE YOUR APPROACH TO DIRECT BOOKINGS

“You should know the markets to help with marketing direct, and use some of your week-over-week arrival data to understand in the short term what type of guests are coming. What are they visiting for? Is it leisure-based or is a certain business segment back up, or is it something in a university market? Anything that can help you get a leg up as a pure sales lead is going to happen in the short term right now. While it’s nice to rebook for 2021, it’s going to be about tracking down smaller things while we’re rebounding.”

- Johnathan Capps, VP of Revenue, Charlestowne Hotels

“It is likely going to be different from the past, so we have to start with fresh data and a fresh mindset on how we reach future guests. Channel, segment, location, booking window, web traffic (what are guests looking at on your site?), conversion, state and local guidelines for both your market and drive markets are all important.”

- Linda Gulrajani, VP of Revenue Strategy and Distribution, Marcus Hotels & Resorts

“Every hotel and every market will have its own set of street corner challenges; thus, they will need to assess the current market situation in order to create and implement an action plan to improve revenue performance. For example, Choice is currently monitoring tracking provided by Google as an early indicator of travel behavior specific to hotels. This allows us to get deeper insight into the mobility of people within a specific region.”

- Douglas Lisi, VP of Revenue Management, Choice Hotels

IN BRIEF

BUILDING OFF ‘BOOK DIRECT’ CAMPAIGNS

In 2018, Kalibri studied 19,000 hotels and 80 million transactions, showing loyalty member campaigns have either strengthened or stabilized the growth rate of bookings through Brand.com while the OTA channel has either held steady or has somewhat decelerated.

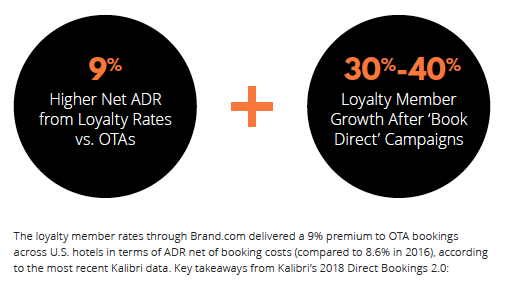

The loyalty member rates through Brand.com delivered a 9% premium to OTA bookings across U.S. hotels in terms of ADR net of booking costs (compared to 8.6% in 2016), according to the most recent Kalibri data. Key takeaways from Kalibri’s 2018 Direct Bookings 2.0:

1. Loyalty members represent the largest customer base for branded hotels in the

U.S. The loyalty base for the hotel industry chains experienced rapid growth of 30%-40% year-over-year from 2015 to 2016, and pace had stabilized but continued

at a healthy rate into 2018.

2. Net ADR for Brand.com loyalty bookings remain higher than Net ADR for OTA

bookings. The ADR for Member Rate/Loyalty bookings still reflects a solid

premium compared to OTA bookings after acquisition costs are removed.

Finding a Healthy Distribution Mix

Hotel revenue departments are faced with some incredible challenges in the current environment. First, unfortunately, many are operating with less staff. And their counterparts in marketing are working with reduced, if not entirely eliminated, budgets.

For many, the immediate reaction is to drop rates and offer steep discounts, praying to attract whatever demand exists in the market. That’s the exact opposite of what hoteliers should really be doing, according to experts.

“Demand has shrunk across the board. You need to measure and understand what’s out there and what’s coming. This is what we’ll use to rebound,” says Johnathan Capps of Charlestowne Hotels. “A wholesale strategy of lowering rate doesn’t buy it. It’s truly about doing due diligence of rate positioning and inventory and distribution controls.

“It’s a long road,” Capps continues. “A lot of young hotel personnel haven’t experienced a downturn yet in their careers. We have lost months of business, and there’s a desperation for ownership and young hoteliers to prove themselves, so a lot go to drop rate. That’s not the answer.”

Instead, hoteliers should focus on developing a healthy distribution mix. OTAs and metasearch can still be a part of a balanced strategy. It always comes back to the cost of acquiring the customer. In some cases, it might make sense to spend more on certain channels, provided the customer and bookings are worth it. So rather than simply cutting certain third parties loose, focus on optimizing those distribution channels, making them work for your property.

“In an environment in which we need to capture demand from as many sources as possible, I would focus on ensuring all channels are optimized, rather than optimizing your channel mix,” says Mike Medsker. “See how you can improve conversion from customers on your website, the OTAs and your voice channels, while driving demand through targeted outreach efforts.”

It’s better to bring in demand now, and then redirect guests to direct channels over time. For example Heather Riddick, director of revenue management at the Long Beach Lodge Resort in Tofino, British Columbia, says staff at her property explain to guests that booking through an OTA isn’t as flexible as direct methods. That education process is also cemented again upon guests’ arrival.

“They learn quickly,” she says.

It’s also not a good idea to be overzealous with special promotional discounts. Just like with cutting rates across the board, a more adaptive approach is better suited to the situation. Hotels that apply a more dynamic and flexible market strategy are the ones that achieve optimal results.

“Hotels shouldn’t work in a strict ‘either/or’ environment, maintaining the rate strategies of another era that don’t reflect the nuances of today’s demand,” says Douglas Lisi, VP of Revenue Management at Choice Hotels. “Realistically, hotels are competing in a market with demand inspired by different variables, so it’s important to be strategic and not simply offer radical discounts to get heads in beds. That’s not to say discounting isn’t a viable solution when appropriate.”

CROSS-DEPARTMENT COLLABORATION

More than ever, marketing and revenue management teams need to work closely together. The age of each department working autonomously in their own silos is clearly over, at least for hoteliers who want to remain competitive in the current environment. It’s not clear yet just how this new era of collaboration will take shape.

“Both will likely have less staff and will be expected to do more, which requires everyone to step out of their comfort zone and learn new things,” says Linda Gulrajani, VP of revenue strategy and distribution for Marcus Hotels & Resorts. “This will naturally change behavior and create different ways of thinking. Hopefully it will continue to drive teams to look at things from a commercial perspective, versus in silos. I also anticipate that hotel companies will start to bring marketing tasks in-house, instead of outsourcing to third parties.”

On the one hand, marketing information can help revenue management staff make better decisions. Both departments can strategize budgets by looking at historicals together, factoring in a host of metrics, including historical net rate after marketing fees.

“When you take those fees out of the rate, instead of a percentage of cost, you’re going to see which ones are the most valuable channels, compared to others that have a higher cost and lower ADR,” says Lily Mockerman of ThinkUp Enterprises. “Those are the stats that should drive where you’re putting dollars for each channel. You should be making the highest investment in the most profitable channels.”

And on the other hand, revenue management pros can provide marketers with the hard data needed to inform a strategic plan. This is especially helpful for marketers who lean more toward the creative than analytic approach.

“If you’re not a strong analytical marketer and you’re a more creative marketer, you can rely on the revenue management team in these measured experiences,” St. Onge says. “Revenue managers are good at looking at data. You should both be in the nitty gritty together.”

Medsker says it’s also clear that additional improvements will need to be made in the technology arena in order to align commercial strategy stakeholders and help them become more agile. Gone are the days of throwing more bodies at inefficient tasks, such as hiring individuals solely responsible for compiling reports.

Hoteliers must seek out resources that enable their employees to cover more ground more quickly, and to take on aspects of the operation with which they

may not be familiar. The employees, meanwhile, will need to become more aggressive about generating demand, versus just gaining it through easy pricing

methods like discounting.

“Changes to departmental structure across sales and marketing will look different from property to property. However, it’s evident that we need to shift our emphasis from harvesting demand through pricing and inventory controls to creating demand,” Medsker says. “ With travel demand currently sitting at all time lows, increasing your revenue will be a zero-sum game requiring you to steal business from other hotels and other markets. Those individuals who can ‘hunt’ will be brought back first, and those who can only ‘harvest’ inbound demand may struggle to find employment for quite some time.”

“Hoteliers will still need to communicate the core essence and reason for the

consumer to believe in the brand and inspire loyalty.”

- Abhijit Patel, Choice Hotels

GIVE DISTRIBUTION ITS DUE

The current state of the industry just reiterates how crucial distribution is to the bottom line, and how valuable distribution professionals are for competing in the modern marketplace. Although revenue management and marketing teams may be devising new strategies to meet new challenges, the core tenets of the discipline remain the same. If anything has shifted, it’s the visibility and scope of the role.

“I currently oversee the distribution role and don’t see that changing,” says Gulrajani. “I do see myself working more closely with marketing as we start to come out of the pandemic and have limited marketing spend and resources. We need to be smart about how and what we are distributing through various channels, to make sure we are driving optimal profit for our hotels.”

Others suggest that as we push forward into this unknown age, it’s also important to remember the core mission of distribution professionals. Whether it’s marketing or revenue management, the foundations of each role remain unchanged.

“We don’t expect our revenue management or marketing functions to look any different from a fundamental level,” says Abhijit Patel, VP of Marketing and Distribution Strategy and Operations. “Revenue managers will still be critical to driving hotel performance and optimizing delivery channels to manage demand and cost pressures. Although marketing budgets and tactics might look different, hoteliers will still need to communicate the core essence and reason for the consumer to believe in the brand and inspire loyalty, especially as brand considerations among consumers increase.”

HOTEL TALK

MAINTAIN AN AGILE DISTRIBUTION STRATEGY

“From the analytics side when we talk about optimal mix, it’s about going into the data. But now we’re not going to act like we did last year or month; we’re going week to week, to look at patterns for stealing share and understanding the days of the week.”

- Johnathan Capps, VP of Revenue, Charlestowne Hotels

“Because I’m not putting specials into the market through OTAs, I’m able to keep them in parity. We’ve negotiated our commissions with them and we’ve had some leverage there, and we’re trying to keep as much as we can.”

- Heather Riddick, Director of Revenue Management, Long Beach Lodge Resort

“The wants, desires, and expectations of the hospitality world, including travelers and guests, are changing as a result of COVID-19. That’s why these changing guest expectations not only need to be met, but also exceeded throughout the customer journey. Hotels need to get creative and be flexible. Frequently changing the

approach to rate management works best, as not only will it keep strategies proprietary, but it can also allow hotels to find what works for their hotel and market.”

- Douglas Lisi, VP of Revenue Management, Choice Hotels

ASK THE EXPERT

DON’T REPEAT PAST MISTAKES

5 Questions with Rod Jimenez, CEO, SHR

Q. How are hotels approaching channel mix as we begin to recover?

JIMENEZ In terms of demand, we’re starting from scratch, so it’s understandable that many hotels are courting whatever demand they can find, however they can find it. Without demand, many of the pre-pandemic conversations about distribution and segmentation mix all go out the window, because hoteliers can no longer pick and choose.

Fortunately this situation won’t likely last forever. As the industry begins its recovery, be agile and resilient, adapting to where the demand is. Driving direct business should always be the goal, but it’s important to realize that you simply cannot stick to goals for direct bookings that were made at the beginning of the year. Resilience is knowing that you might have to switch for the time being and adapt to where the demand is, but also knowing that you can’t stay there forever.

Q. What revenue strategies do you suggest in the current environment?

JIMENEZ The knowledge is there, but you must use it. Once demand returns and distribution and segmentation become active again, it will be time to resume applying knowledge systems to execute a more restrictive strategy. That’s why your arsenal of data tools is more important now than ever.

It’s crucial to measure the data — the bookings and demand that flow into the property — to see how you can potentially do better. This includes revenue teams measuring the cost of acquisition as demand starts to trickle in again, to make smarter decisions based on which channels send the most profit to the bottom line.

Q. How does direct business help hoteliers better know their guests?

JIMENEZ Hoteliers can use the data systems at their disposal to build on their knowledge of their segments and guests, especially knowing who their “best guest” is, even if the hotel isn’t necessarily being all that picky right now about who books a room.

Historic trends and the practice of following the comp set down the street no longer apply. Knowing your best guest — as well as the guest you have to cater to right now — offers something real for this moment in time, which you can use as a guiding path for your overall distribution strategy going forward.

Q. How can hoteliers stand firm on these strategies?

JIMENEZ Be a leader, not a follower. When you see your competitors reacting in the short-term — dropping rates, selling on every channel available, getting any business they can, etc. — it’s fine to follow along in the early stages of the

recovery, but be prepared to turn the tables and take on a leadership role the moment demand returns.

Q. What advice do you offer hoteliers in this time of uncertainty?

JIMENEZ Learn through it. As hoteliers continue to operate in crisis mode, many questions remain as to what working again toward those pre-pandemic goals will look like. It’s OK to learn through it — you won’t be alone in the experience — and find a way to eventually get back on track. But attempting to deliver on your goals from the beginning of the year is just going to lead to disappointment. Start over and figure it out as you go.

CONCLUSION

Don’t Hand Over the Keys

In the end, hoteliers must be cautious not to hand over the keys to their inventory to OTAs like they’ve done repeated times in the past. Otherwise, at some point down the road when demand has returned, they’ll be looking back and kicking themselves.

“What we can’t do, as hoteliers, is repeat the same mistakes we’ve made in the past. While it seems most hotels have learned the valuable lesson that discounting doesn’t spur demand, it will be tempting for operators to take heads in beds at any

acquisition cost,” says SHR CEO Rod Jimenez.

Even with their recent struggles, hotels won’t outspend OTAs on marketing. Distribution partners serve an incredible purpose, but it’s incumbent on hoteliers to massage their ideal distribution mix.

Where can hotels get support to increase their direct traffic and rely on OTAs only for niche, targeted, incremental demand? Linda Gulrajani of Marcus Hotels & Resorts, suggests the following:

• Hospitality Sales and Marketing Association

International (HSMAI)

• Hotel Electronic Distribution Network Association

(HEDNA)

• Google Certifications

• Distribution partners (reservations providers, OTA

market managers, etc.)

• Representation partners (Preferred Hotels,

Leading Hotels of the World, Associated Luxury

Hotels International, etc.)

• Revenue Management System partners

Abhijit Patel of Choice says trusted loyalty programs will remain a key differentiator among consumers because “when points translate into valuable

rewards, they motivate and inspire consumers to book.”

“This presents an opportunity for independent and boutique hotel owners, because not only can they align with companies that have worked to establish trust and loyalty among consumers, but they can also improve their reservations delivery, reduce customer acquisition costs and improve their revenue management tools,” he says.

But Mike Medsker says that while brands are quick to tout their rigorous standards and extensive database reach, unflagged assets often provide the highest upside potential for owners seeking to maximize their returns.

“It’s important that independent management teams are equipped with the proper tools to monitor incoming demand patterns and react in real time,” he says. “Otherwise, they risk ceding ground to their branded competitors with robust analytical tools.”

The world has changed considerably for hoteliers in the past few months, and the smartest hoteliers will take this time to reexamine their current distribution processes and determine whether they are in the best position to successfully drive long-term profitability.

Learn more hospitality's only integrated, AI-enhanced revenue generation engine: CRS, RMS, CRM